I’ve had to rewrite my introductory paragraph three times in an attempt to not sound like a raging Chicken Little, but I must say this succinctly:

Commercial real estate, construction, and multifamily properties and projects are in a world of hurt. It is going to get worse. If there is any question as to value today simply rip the band-aid off quickly and take the pain.

There I said it. Indulge me for a few moments if you would. If you know anything about commercial real estate you probably know that values rest largely on three factors.

- Demand: How much more is one guy willing to pay than the next. In commercial real estate this is expressed as a cap rate generally. Cap rates are inversely proportional to value. Think of them as interest rates or simply rates of return. It’s the same as any other investment in that the cap rate speaks to the perceived risk in the location, asset type, tenant mix, etc.

- Building Fundamentals: How much money is coming? How strong are your tenants? How likely are you to keep the income? What upside is there? How desirable is the location?

- Leverage: To what degree is positive leverage available?

I’m sure I’ll get a slew of comments deriding me as simple or slow, but these factors are at the core of value; so let’s break it down. Demand from an acquisition standpoint is WAY off. I recently ran a survey of commercial real estate professionals, 200+ responded and investors believed cap rates would rise by 2.3% over the coming year. I’ll show you the math on this in a minute. That means that if you would buy at 7.5% today you’re putting that same property at 9.8% next year. Don’t fall asleep on me yet, this is going to get interesting, I promise.

Building fundamentals have mainly to do with who is renting your property and for how much. Across the board we are seeing reductions in rent by 20% and more. We negotiated, for ourselves, a rent reduction of more than 20%. Add to this increased vacancy and you can see where I’m going with point number two.

Leverage… suffice it to say that leverage has to do with the availability of borrowed capital, usually from banks or in the case of commercial real estate the CMBS market. If you haven’t been under a rock you know what I’m going to say.

Ready? Here’s the math. I was on a recent conference call where analysts at costar were answering the question “Is a 40-50% drop in values really real or is that some kind of inefficient market blip because the banks aren’t lending?” and their response was the question should be “Is a 75% loss of value really real?” …. that is what we’re talking about.

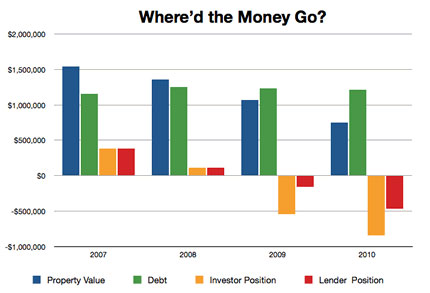

Check out the accompanying graph below to understand where commercial property values are going. This model uses a property that sold in 2007 with at a 6.5% cap rate, with a 75% LTV, on a 25-year amortization schedule with a 7% rate. It assumes the aforementioned cap rate decompression and a slow (5% after the first year then 10% in each of the 2 subsequent years, totally realistic) drop in NOI as a result of lower rental rates and higher vacancy.

Stay tuned for my follow up article where I’ll tell you the shocking truth about what’s happening at the banks right now and why it is going to result in a cascade of distressed commercial real estate opportunities coming to market and a slew of bank closures. I’ll tell you who the culprits are and what can be done.

You’re absolutely right. The commercial market is going to be in a world of hurt—-more so than it is now. I had put up a blurb about this on real estate industry watch a little while ago.

It is amazing that so few are talking about what is really taking place in commercial real estate. It always lags residential, and this time it is a major tsunami that is going to start striking REITs, local and regional banks that are not under a TARP bailout. Kind of scary!