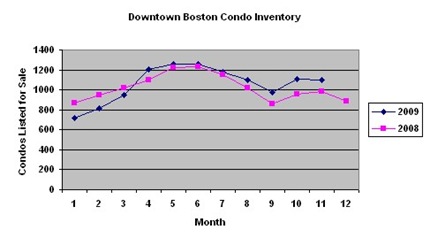

While transaction sales volume in downtown Boston has been off year over year, meaning that there are less condos actually selling in 2009 versus that which sold in 2008, what’s happening to inventory? Inventory represents the supply of choice that buyers have in the marketplace, and given the economics of the situation, can have an impact on prices as well.

While downtown Boston condo inventory began the 2009 calendar year below 2008 levels, it has tracked very closely with numbers from the previous year. This trend continued up until August of 2009, when inventory levels did not drop off as substantially as in 2008 – August historically represents the month when inventory levels push down through a post summer dip, which typically lasts through the end of September.

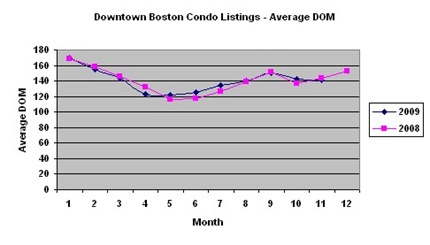

November 2009 condo inventory is up approximately 12% from the same time period in 2008, yet the average days on market (DOM) that a condo is sitting for sale is virtually the same that was experienced in 2008. By reading between the lines, despite inventory levels being slightly up, transaction sales volume on a percentage basis is actually down more, thus, the absolute number of new listings hitting the market has decreased year over year. Nonetheless, choice, at least at the superficial level of number of current listings available for sale, is still quite good for buyers.

Downtown Boston neighborhoods considered include: Back Bay, Bay Village, Beacon Hill, Chinatown, Financial District, Leather District, Midtown, North End, Seaport District, South Boston, South End, The Fenway, Theatre District, Waterfront, West End