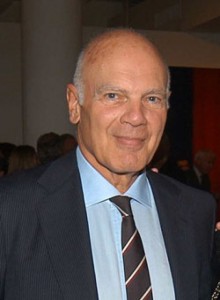

It’s a small world, and you never know who is listening. Steven Roth, the chairman of Vornado Realty Trust found this out first hand after experiencing a backlash from Boston Mayor Thomas Menino following comments made by Roth while at a business school in New York City that indirectly tipped his hand about Vornado’s planned course of action with the Filene’s Basement One Franklin Tower site, which is currently a large hole in the ground amongst tarp wrapped buildings.

Earlier in March, Roth, billionaire Vornado chairman and primary owner and co-developer of the Filene’s Basement site at Downtown Crossing, told a Columbia University audience that in the mid-’90s he purposely let the former Alexander’s department store construction site on Lexington Avenue in Manhattan sit vacant and become increasingly blighted for more than three years, despite complaints from city officials, in a grand plan to force the city’s hand to provide public money for site development.

“The more governments would want this redeveloped, the more help they would give us when the time came,” Roth is purported to have said. Mayor Menino and the City of Boston feel that the Filene’s site, which represents an anchor space in Boston’s Midtown Downtown Crossing neighborhood, is too important to sit vacant and blighted, and to be used as a bargaining chip. Menino is threatening Vornado’s Roth with a hardball eminent domain play that may force Roth’s hand or clear the way for a new developer’s entrance.

Filene’s One Franklin Tower History

Vornado Realty Trust acquired the Filene’s Basement building in Downtown Crossing in July 2006 for $100 million after Federated Department Stores closed it. Filene’s Basement remained in operation at the site on a sublease until fall 2007, when the store was closed to make way for the $700 million mixed-use redevelopment of the site into a 38-story tower, including 1.2 million square feet encompassing office, condo, and hotel space. Filene’s Basement had expected to open a new store twice its previous size there (along with Target and Zara), in spring 2009 upon the project’s projected delivery. Vornado made its first Boston real estate acquisition in September 2005 with the $96 million purchase of the Boston Design Center in South Boston from the Davis Cos. The Filene’s Basement building purchase placed Vornado as landlord and co-developer with Gale International Realty.

On June 15, 2009, Syms Corp, in a joint venture with Vornado, won a second Filene’s Basement bankruptcy auction (the first involved Men’s Wearhouse rescinding their bid) at $62.4 million. On June 17th, a bankruptcy judge approved the sale, which included leases for 23 Filene’s Basement stores, its trade name, inventory and distribution center. This move gave Vornado a more overall strategic hold on Filene’s direction and holdings, however, the Filene’s Basement Downtown Crossing sublease was excluded from the Syms-Vornado joint acquisition, instead, Vornado took over control of the entire lease. Vornado entered into such a lease back for additional protection against $500,000 a month penalties that would be in place until the redevelopment project saw completion.

Steven Roth Upsets Boston Mayor Menino

On Wednesday, March 3, 2010, Steven Roth, chairman of Vornado Realty Trust, was the keynote speaker at a two-hour Columbia University Graduate School of Architecture, Planning and Preservation lecture called ‘The Real Estate CEO, Steven Roth’. During the lecture, the (New York City) Bloomberg LP tower at Lexington Avenue and 59th Street on the former Alexander’s department store site was discussed. It was purported that Roth spared little detail in explaining that, as site owner and developer, he had almost no basis in the (Bloomberg LP tower) land during the mid 1990s, and it was in his best interest to purposefully allow the building to become an increasing blight, to which the government would need to lend a helping hand in the form of subsidies and the like to spur redevelopment.

Less than a week after Roth’s Columbia appearance and comments, Boston Mayor Thomas Menino, onto Roth’s scent about the possible use of the same technique with the Filene’s Basement building, fired a letter to Roth, in which he called Roth’s alleged remarks “simply outrageous.” In Menino’s letter, he went on to say, “admitting that you embraced a deliberate policy of long-term blight, at a major commercial location in New York City, exhibits a callous disregard for the well-being of the city and its people. Blight kills jobs by destroying an area’s appeal to businesses and customers. It destroys a neighborhood’s residential appeal. It drives property values down, and it promotes crime. The notion that you would purposefully cause this to occur – not due to financing difficulties or other problems beyond your control, but as an intentional cynical ploy to extract concessions from the public sector – is inexcusable.”

Menino Threatens Vornado’s Roth with Eminent Domain

Responding to what he called a “consistent policy of indifference” and saying he won’t let the site “lay dormant,” Menino continued in his letter to Roth, “I am directing the Boston Redevelopment Authority to examine eminent domain options for the One Franklin Street site. I will also ask that the Authority re-evaluate the approvals it has already given this project. This development is too important to Downtown Crossing and to the entire city of Boston to be used as a bargaining chip to improve your bottom line.”

Eminent domain refers to the power possessed by the state over all property within the state, specifically its power to appropriate property for a public use.

Vornado has arguably spent millions of dollars, and almost 4 years trying to redevelop the Filene’s Basement site at Downtown Crossing into the One Franklin Tower development, and today, the site sits abandoned, a large excavated hole surrounded by the remaining site structures wrapped in white tarp and fencing with pictures of what should be to come.

Perhaps Steven Roth knew that Boston would be listening when he spoke at Columbia earlier this month. Perhaps it was a calculated decision to speak out in such a way, either as a mechanism to disengage from the property entirely, or, make an understated point to the City of Boston that he will need more explicit help if the project is to be completed. It could be argued that Roth would be happy to walk away from the Filene’s site via eminent domain, a police power that the state can execute on, but would involve Massachusetts “justly compensating” Vornado for the land.