While the recession enders cheer positive signs in the stock market hailing the return of the bulls, everyone else seems to be wondering where the jobs are, and real estate industry folks are pointing at the long shadow being cast by the coming wave of commercial real estate problems. While there are no answers to the employment numbers or the stock market, there may be a real estate crystal ball.

It is all about the banks. Banks not only control the reigns to capital and reasonable debt, at a time like this when debt positions are the only positions left in real estate, banks control a whole lot more. In fact recent bank data suggests that institutions are in control of hundreds of billions in real estate. How they handle it will affect us deeply. In this installment we’ll look at the 180 (more or less) local lenders are dealing with in terms of real estate and what to expect next.

Massachusetts’ banks are generally fairing better than the those nationally when it comes to real estate loans. Approximately 2.2% of all the banks in the US are headquartered in MA, while our banks only hold about .44% of the real estate problems. This is a good start. The most recent consolidated bank reports available show that MA banks hold only about $1.27B in problems. A drop in the bucket compared to the $290B+ in whole loan and REO problems with lenders nationally.

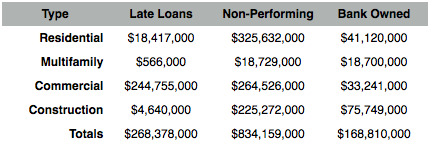

It’s not all peaches and cream though. Many things are tracked, but 3 of those things fall into the distressed real estate pipeline, including 90 day late loans, nonaccrual loans, and REO. For each of these three columns we track residential, commercial, construction, and multifamily problems. In nearly all cases, and in almost every category, distressed real estate balances are growing nationally and locally.

Dollar Volume of Distressed Assets at MA Banks

Massachusetts based banks are reporting increased real estate problems.

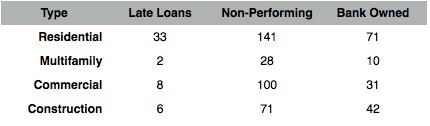

Number of Massachusetts Banks with Distressed Assets

More Massachusetts based banks are reporting problems.

Do you notice a pattern?

Let’s ignore the first column for now because 90-Day-Lates are not as good a forecasting tool as non-accrual or non-performing loans. In nearly every category problems are mounting, not just with individual banks but across a greater number of banks. If a crystal ball exists though, here it is in the numbers.

The hunch is on continued problems across the real estate spectrum, more struggling banks, more struggling property owners and certainly more great deals for those with capital. The next 18-24 months should prove to be very exciting for those prepared.