I’ve put together a report that outlines the markets and housing types that I primarily deal with, Back Bay, South End and Fenway condominiums and Mission Hill multi-family investment property. The purpose of such a report is to present an unbiased market snapshot and to draw some insightful conclusions based on general knowledge of the markets as well as economic insight.

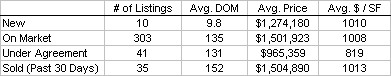

First, here are some high level data points for Back Bay condominiums gathered earlier today:

Based on these market statistics the current absorption rate for the Back Bay is 38 weeks, average market time is roughly the same, at 35 weeks. It appears that inventory in the Back Bay is taking longer to sell then historical averages.

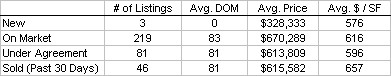

Next, a look at South End condominiums:

Based on these market statistics, the current absorption rate for the South End is 21.9 weeks, average market time is slightly lower around 12 weeks. It appears that inventory in the South End is moving quickly compared to other Boston neighborhoods in this report.

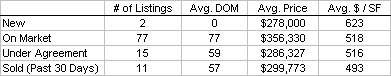

And from a condo perspective, let’s finally look at Fenway condominiums:

Based on these market statistics, the current absorption rate for the Fenway is 12 weeks, average market time is lower, around 8 weeks. This leads me to conclude that Fenway inventory is moving at a rapid pace, in fact, faster than any other neighborhood covered in this report. I will expand on this in the conclusion.

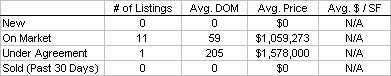

And finally, a look at Boston investment property in Mission Hill (Multi-Family Units)

The absorption rate in Mission Hill is currently at 0. There has been a large amount of inventory to hit the market recently and not much of it is moving. Prices are slightly higher based on 6 month average cap rates which could be a factor; however, it is my belief that financing difficulty and a slow rental market are the key factors in the slowdown of the Mission Hill investment property market.

The market in the above mentioned neighborhoods is still moving and it appears that the lowest end of the price range, The Fenway, is moving the quickest. There are a few factors that contribute to these trends, and I think the most influential is the availability of financing to first time home buyers and financing for non jumbo loans. The greatest pool of buyers seems to be first time buyers and thus the direct correlation with the Fenway having the shortest market time. These figures overlap the expiration of the home buyer tax credit so the true indicator of the validity of this hypothesis will come next month when we see what has happened without the credit in place. If you have any questions on the above figures please feel free to contact me directly and we can discuss – my number is 440-479-0420.