After moving through June, traditionally one of the most active months of the year for real estate transactions, the downtown Boston residential real estate market shows interesting signs of vitality.

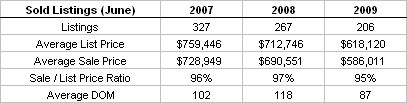

Over the course of 2007 to 2009, during the month of June, the number of listings that sold (see table immediately below) in downtown Boston has steadily decreased, along with average list and sale price. Sale to list price ratio has remained relatively steady in the mid 90 percentile, in part meaning that homes continue to be priced by Sellers in line with the expectations of Buyers, albeit, on average, lower.

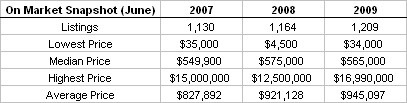

The amount of time that a property is remaining on the market, however, has been decreasing year over year. And if we look at a snapshot of what homes are/were on the market in June of each year from 2007 through 2009 (see table immediately below), inventory levels are staying relatively steady (with a slight increase). The average list price for a home in downtown Boston has trended up, yet this is largely a function of multiple $10 million + properties that are on the market currently.

While the data herein represents an admittedly small slice of current market conditions, and thus it’s dangerous to make too many far reaching assumptions based off of a cursory analysis, some insight is provided. Rather than focus on (the decline of) average list and sale price of homes in downtown Boston, a figure that can be swayed by a potentially unrepresentative mix of homes actually sold during the analysis, let us key in on the average days on market (DOM), along with inventory levels, and sale to list price ratio. The amount of choice Buyers have on the market is as good as it has been in several years, however, homes are being priced relatively accurately (in the context of what Buyers are willing to pay versus the expectations of what Sellers are willing to list at), and relatively speaking, units are selling faster than they have over the past several years.

Data was compiled using the Boston MLS (MLSpin) across the downtown Boston neighborhoods of Back Bay, Beacon Hill, Financial District, Leather District, Midtown, North End, Seaport District, South Boston, South End, Fenway, Theatre District, Waterfront, and West End.