After a decade of delays and changing hands several times, the parcel at 691 Massachusetts Avenue is finally going to be developed. The first of the pre-construction condos, 10 in total, have hit the market and are ready for buyers to line up. The project is still in the early stages of construction and currently there is no model unit available. However, it should not be too long until buyers are able to walk through the property as occupancy is expected sometime during the summer of 2011.

This parcel has gone though many variations of planning stages and the site that was once an active parking lot is now going to be one of the newest condo buildings in the South End; let’s examine the history. During the 70’s-90’s this parcel was all but forgotten about and as urban decay set in it became just another neglected piece of property in the gritty South End. Then about 10 years ago, the land was put up for sale and subsequently purchased by a group of developers looking to build 4 or 5 more row houses in a continuation of the surrounding buildings along Mass Ave. After the purchase, the developers had plans drawn up and went through the city’s tenuous approval process and spent several years getting their project green lighted. After completing this process in 2002, the developers decided to sell the project with plans and permits in hand to Urbanica development, the same developers that completed the 24 unit luxury condo project known as D4 the former division 4 police station in the South End. Urbanica, however decided that the time was not right in 2002 and that the approved design was too bland. For the project to be a success, construction would have to wait until a radically different project could be drawn up and then approved. A new concept nearly doubled the number of units to a total of 40 and the design changed from a bow front brick façade building that would seamlessly blend into the neighborhood to a modern green building with a glass and masonry façade that will significantly stand out against the back drop of brick row houses.

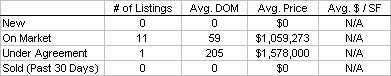

The revised project is now being branded as “six9one residences” , consists of 40 total units with a mix of studios, one bedrooms, two bedrooms and penthouses. Pricing varies, drastically across the inventory, and of the 10 units on the market, 8 are one bedrooms with an average size of 675 square feet and an average price of $385,000 or $570 square foot. The penthouses top out at $975,000 for nearly 2,000 square feet. All of the pre-construction units include deeded parking with the option to purchase an additional space. The condo fees are a bit higher than those of the surrounding condos in a typical brownstone, but the fees at six9one residences include heat, hot water, gas, a/c, elevator maintenance and security, all items that are rarely included in the budget of a brownstone.

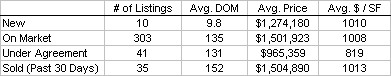

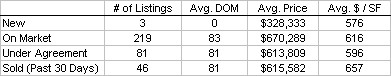

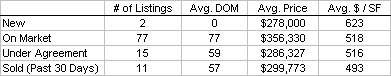

With the surrounding condo market in a bit of limbo, it will be interesting to see how this aggressive pricing plays out. Are buyers willing to pay top dollar for brand new trendy units on Mass Ave? Will these units sell before completion or will buyers demand a finished product before jumping in?